A small business loan1 with your goals in mind.

-

-

Flexible loan amounts

Choose loan amounts from $25,000 to $500,000. -

Revolving line of credit or term loan

Select a revolving line of credit with a variable interest rate3 for uses including seasonal cash flow, bridging accounts receivables and payroll. or Select a term loan with variable3 or fixed4 interest rates for up to 7 years for uses including purchasing new equipment or supplies and leasehold improvements. -

Added savings

Save money with a waived origination fee.5

Choose the Business Checking account that works best for your small business.

Our clients say it best

-

See Muir’s Story

Learn more

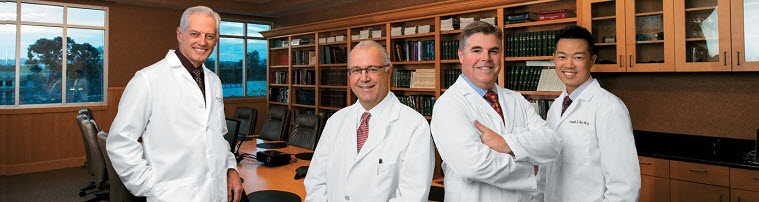

Learn moreFirst Republic is always there for us — from remodels to equipment purchases — they are our partner in growth.

Muir Orthopaedic Specialists

Northern California

Client Since '01 -

See Kaye Moser’s Story

Learn more

Learn moreThey treat us the same way we treat our clients...no other bank can even come close.

Kaye Moser Hierbaum Ford LLP

San Francisco

Client Since '04 -

See Vincenti’s Story

Learn more

Learn moreFirst Republic understands how a law firm operates. They have an instinctive sense of what we need and how fast we need it.

Vincenti & Vincenti, P.C.

New York

Client Since '07

© 1997–2021 First Republic Bank.

Banking products and services are offered by First Republic Bank, Member FDIC and Equal Housing Lender1 This is not a loan approval or commitment to lend. Loans are subject to First Republic Bank’s underwriting standards and verification of documents provided. This loan is on demand. You will be required to repay the loan in full if a demand is made at any time or for any reason. Applicant must meet a First Republic banker to open account. Applicants should discuss loan terms, conditions and account details with their Relationship Manager.

2 To qualify for the 6-month introductory rate of 1.95%, borrower must be a new Bank business account client. After 6 months, the interest rate will automatically revert to the variable or fixed rate identified in borrower’s loan agreement. Variable interest rates may range between 2.25% and 5.25%, subject to Prime Rate and other conditions described in footnote 3. See footnote 4 for fixed rate information. Offer for the introductory rate is valid for applications received through December 31, 2020 and is subject to change without notice. Ask your banker for details.

3 Variable interest rate is current as of July 31, 2020, subject to change daily and based on the Prime Rate, as published in The Wall Street Journal. To qualify for the advertised rate, the Business and/or Guarantor(s) must maintain a combined checking deposit amount at First Republic Bank (the “Bank”) of at least 150% of the loan amount. Rates vary based on applicant’s deposit relationship with the Bank and may be increased to the Bank’s standard rate if the agreed upon deposit amount is not maintained for the life of the loan. Applicants must open a First Republic checking account with automatic loan payment. Minimum opening balances will vary and a monthly fee may apply if the required minimum average balance is not maintained. If at any time during the life of the loan the borrower does not maintain auto-debit of loan payment, the interest rate may be increased by 3.00%. Fees and other terms and conditions apply. Offer is subject to change without notice. Ask your banker for details.

4 Fixed-interest rates available for term loan only and may be higher than advertised variable rates.

5 Fee waiver effective until December 31, 2020, and is subject to change without notice. Terms and conditions apply.

6 Earnings credit rate (ECR) will determine your earnings credit (EC) for the month. The ECR is determined by the monthly average collected balance (“balance”) range maintained in your Business Analyzed Checking account. 1.00% ECR applies to balances up to $500,000 and 1.25% ECR applies to balances above $500,000. Ask your banker for details including how ECs are calculated and applied to bank service fees. The ECR program is subject to change without notice.